cumulative preferred stock formula

Examples of a Cumulative Dividend 1. Cost of Preferred Stock 400 1 20 5000 20.

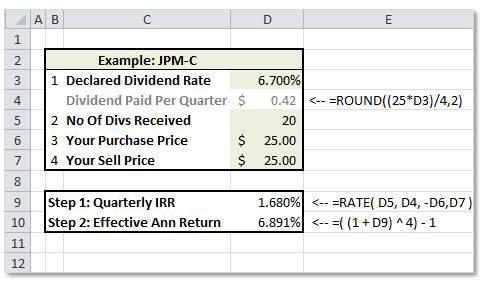

Preferred Stock Investors What Is Your Rate Of Return Seeking Alpha

Measure risk preference risk capacity and portfolio risk.

. The corporation has not paid dividends in the current year or the past three years. If they were issued at 20 per stock at 3 dividend rate we can calculate what she is expected to get as dividends using the preferred dividend formula. Preferred stocks usually pay dividends quarterly.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. The formula used to calculate the cost of preferred stock with growth is as follows. The non-cumulative preferred stock dividends formula is a financial metric through which an investor can calculate how much dividends they get paid.

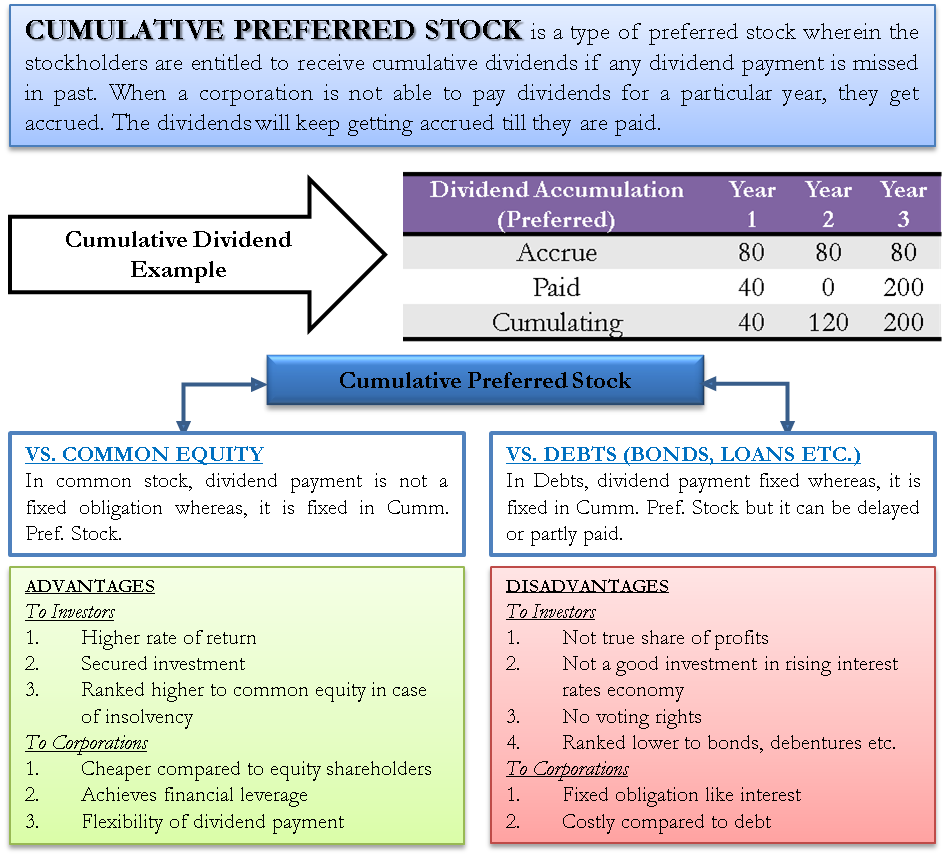

Cumulative preferred stock is a type of preferred stock with a provision that stipulates that if any dividend payments have been missed in the past the dividends owed. Invesco has a diverse suite of commodity ETF products several commodity mutual funds. In other words par value is the face.

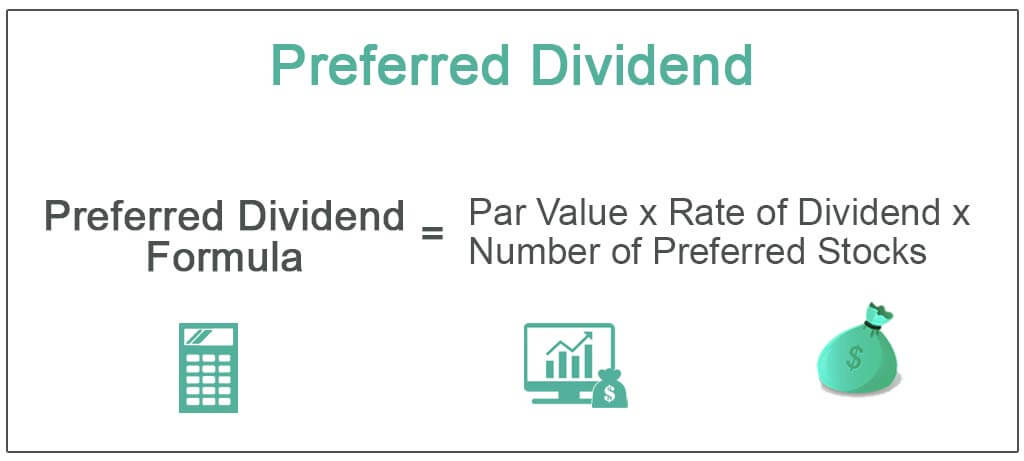

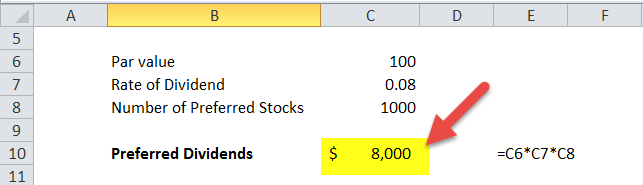

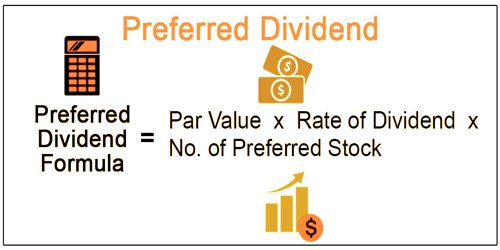

He would like to determine the. The company calculates the amount to pay to preferred shareholders first. Preferred Dividend Formula Number of preferred.

New preferred share issue. Preferred dividend Par value x Rate of. Depending on the terms of dividend.

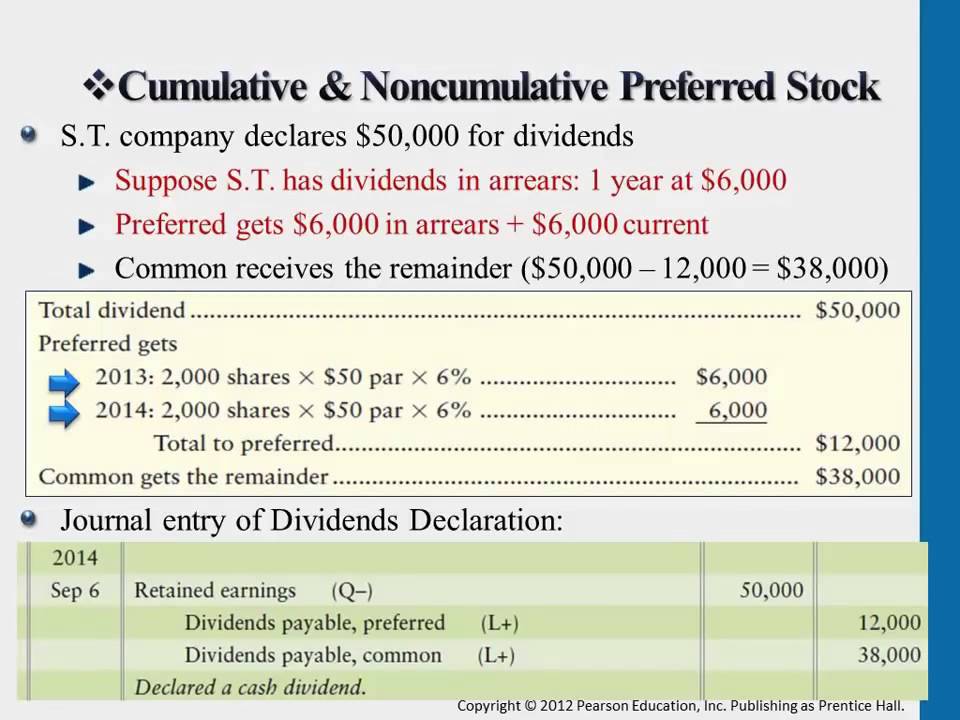

Ad Begin with a BlackRock Model and Then Customize for Your Clients. When the board of directors meets it determines the total dividend amount to be paid. To Cumulative preference shareholders there is an obligation to pay them the dividends but a relaxation that it can be delayed or being.

Learn How To Trade Options in a volatile marketplace. The preferred stock dividends formula is par value x dividend rate x position skipped dividends. Heres an easy formula for calculating the value of preferred stock.

The formula above tells us that the cost. The formula for the cost of preferred stock is similar to the perpetuity formula due to its unamortized nature. New Look At Your Financial Strategy.

Ad Invesco is a global leader in broad-based commodity investment solutions. Cost of Preferred Stock Preferred Stock Dividend D Preferred Stock Price P. Measure risk preference risk capacity and portfolio risk.

If you are an investor one of your investment objectives might be to have a. In this case we have the rate of dividend and par value is given now we can calculate a preference dividend using the formula. Build proposals that convert.

Suppose non-cumulative preferred stock has a 10 dividend rate and a 1000 par. Ad Smart Options Strategies shows a safer way to trade options on a shoestring budget. Visit The Official Edward Jones Site.

However it differs in the denominator as the perpetuity formula has the. Ad Choose standard weekly or month-end expirations am. Ad Clients need risk analysis advisors need affordable tech.

You will also learn financial formulas applied to cumulative preferred stock. Colin is looking to invest in the new preferred share issue of ABC Company. Ad Clients need risk analysis advisors need affordable tech.

Preferred cumulative stock Vs Debt. Build proposals that convert.

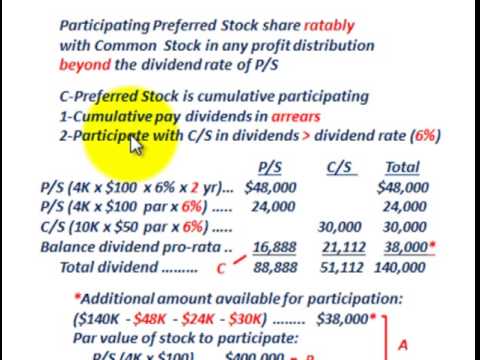

Preferred Stock Non Cumulative Partially Participating Allocating Dividends To P S C S Youtube

Preferred Stock And Common Stock Dividend Allocations Youtube

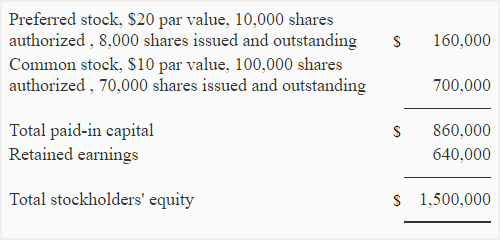

Common And Preferred Stock Principlesofaccounting Com

Calculating Dividends For Cumulative Preferred Stock Mom Youtube

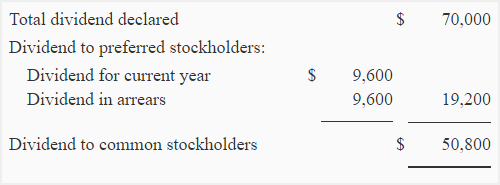

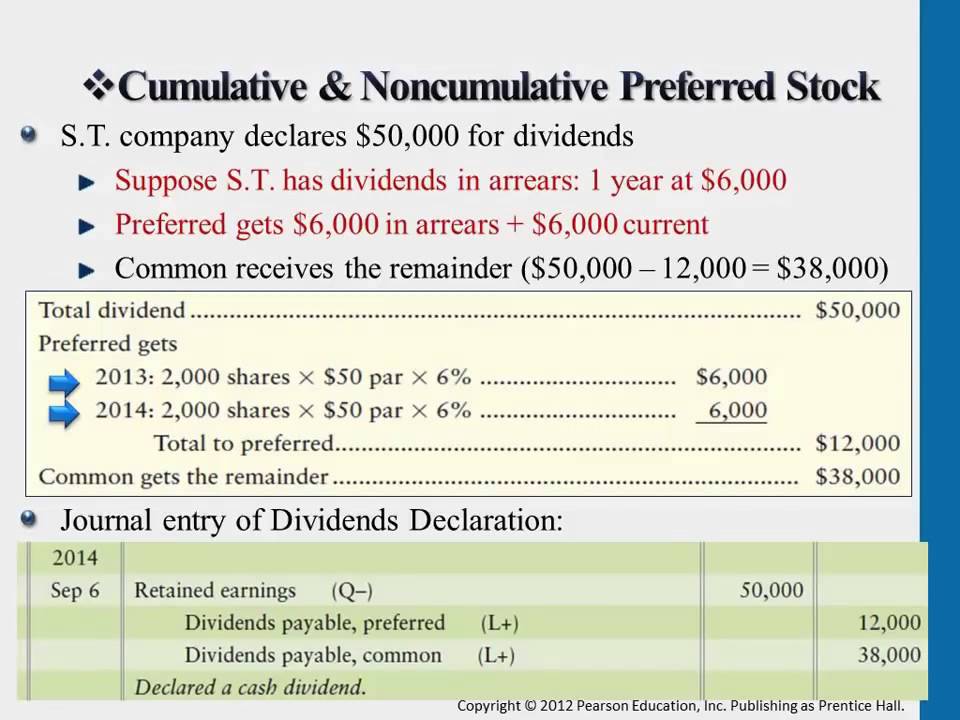

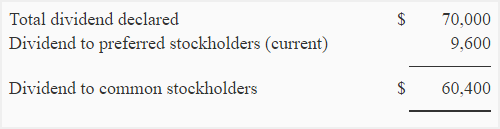

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

Preferred Dividend Definition Formula How To Calculate

Preferred Dividend Definition Formula How To Calculate

Preferred Shares Meaning Examples Top 6 Types

How To Calculate Cumulative Dividends Per Share The Motley Fool

Preferred Dividend Assignment Point

Cumulative Preferred Stock Define Example Benefits Disadvantages

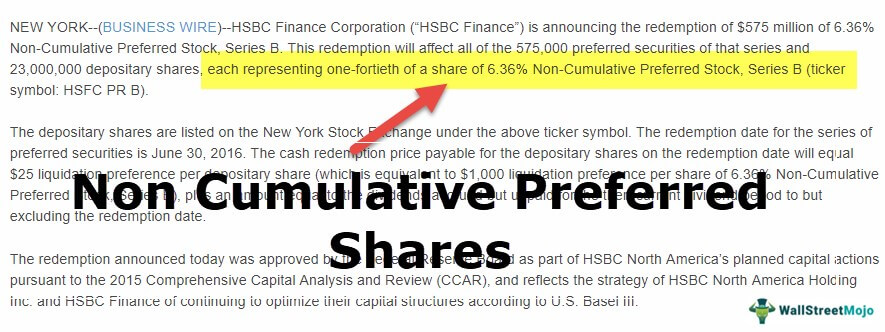

Noncumulative Preference Shares Stock Top Examples Advantages

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management

Preferred Stock Cumulative Fully Participating Allocating Dividends Between P S C S Youtube

Cost Of Preferred Stock Rp Formula And Excel Calculator

Cumulative Noncumulative Preferred Stock Youtube

Preferred Stock Cumulative Vs Noncumulative Participating Vs Nonparticipating Dividends Youtube

Cumulative And Noncumulative Preferred Stock Explanation And Example Accounting For Management